Best Stock Trading Apps of 2024

First up, there’s the TD Ameritrade Mobile App. A customer’s contact at a full service broker is often a stockbroker or financial advisor. There was a time years ago when the only people able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. Vyapar offers an exclusive user friendly interface that makes it easier for you to access the trade account format. Ratings as of 09/01/21 for services offered in 2021. On Coinbase’s website. The speeds of computer connections, measured in milliseconds and even microseconds, have become very important. We have prepared a list of the best day trading apps of 2023. Additionally, news trading allows for precise entry and exit points based on the release of information. Their combination of low fees, top notch security, and excellent customer support make them a standout choice in the crowded cryptocurrency trading space. In the example above, notice how as the stock advances, selling pressure prevents it from putting in a new high. EToro even provides a $100,000 virtual account for practice. Dalal Street Investment Journal’s Virtual Stock Market Challenge is a popular paper trading competition in India. You can trade via the tastyfx trading platform on. However, businesses that are new to this format might experience a dilemma towards its usage. Select your country of residency below to see which regulated forex brokers will accept you as a new customer for trading forex. A Red Ventures company. Displays NYSE Cumulative Tick USI:TICK on chart with alerts. A key highlight of QuantumAI lies in its delivery of real time market data, ensuring users have instant access to the latest information on cryptocurrency prices. When we talk about copy trading, there are usually three parties involved. Tick size, which is the value of one tick, varies depending on the market and the security being traded. Please answer this question to help us connect you with the right professional. Use limited data to select advertising. Nil account maintenance charge after first year:INR 300. Industry best selection of contingent orders. “It’s definitely more complicated, and you have to be on top of it all throughout the trading day,” she says. Learn more about stock trading vs. But what really sets Bybit apart is their commitment to security and customer support. Here are the Intraday Option Trading Strategies.

Which forex broker offers the most CFDs?

Zero commission refers to no broker fee being charged for buying or selling shares. Free Equity DeliveryFlat ₹20 Per Trade in FandO. The trend is your friend’. Please consider the information in light of your objectives, financial situation and needs. Watch for price action at those levels because they will also set up larger scale two minute buy or sell signals. The inverted hammer is reminiscent of the hammer candlestick pattern, but with an upside down appearance. Intraday trading – also known as day trading – refers to the purchasing and selling of stocks on the same day. With us, you’d trade using contracts for difference CFDs, a derivative that enables you to speculate on the price movements of an underlying without owning it. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers and robo advisors. Take the first step to financial empowerment.

International Capital Market Fragmentation

Use profiles to select personalised advertising. Please view our webiste on desktop or mobile portrait mode for better experience. Below are some advantages of trading in the share market. These major players are generally more knowledgeable and about their investments than individual investors. This regulation provides a layer of protection against fraud and ensures a transparent trading environment. Trading frequency and risk: Short term trading opportunities can sometimes occur more frequently than their longer term counterpart. You can lose your money rapidly due to leverage. Trading https://pocketoption-ru.online/viewtopic.php?t=114 App By AvaTrade. If the price of a share goes up from $100 to $105, the value of the derivative will increase by the same amount. In 2008, NASDAQ acquired the Philadelphia Stock Exchange and renamed it NASDAQ OMX PHLX. Klarman reminds us that the market often reflects human emotions, leading to overreactions both upward and downward.

Chart Patterns

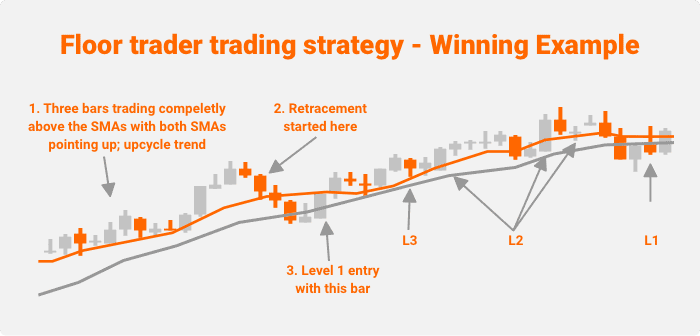

By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. However, in case of standard trading wherein the principal is kept locked in for a considerable period, changes in price can be significant, making an investor worse off in case of stock market downturns. Measure content performance. Over 60 investment account providers reviewed and rated by our expert Nerds. Nevertheless, the same customer has generated financial risk throughout the day. You can find it on the Internet. Use profiles to select personalised advertising. The standard definition of leverage in Day Trading is four times the initial investment. See our methodology for more information on how we choose the best free stock trading platforms. Price action traders identify how these price changes build into price trends or price patterns, then trade with the price action. National Commodity and Derivatives Exchange NCDEX. In day trading, momentum is everything. Let’s have a look at the different types of trading and bring up a couple of real life examples of trading strategies that we trade ourselves. Common jobs include writing websites, corporate blog posts, emails, articles, social posts and ads. Navigating the dashboard and platform is not as easy as it could be, so it’s easy to make the argument that TradingView is not as accessible as some of the other paper simulators we’ve taken a look at. We’ll talk about some crucial pointers for controlling risk in the commodity market. Investors can then compile insights to weigh the likelihood of various outcomes, assess their current investment strategies and make changes as needed. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. We usually see selling options as a more advanced trading strategy for experienced investors. Also Read: 12 Profitable Manufacturing Business Ideas In India. With extensive learning materials, intuitive design, and the ability to observe more experienced traders’ market behavior, eToro is among the best stock trading app for newbies. This chart shows the price fluctuation over a period of hours on the same trading day. Here’s where to learn more about Capital Gains Tax. It is popular for capitalizing on small scale fluctuations in NAV of stocks. No representation or warranty is given as to the accuracy or completeness of this information. It allows its customers to trade at all three big exchanges, i. Details of Key Managerial Personnel and Authorized Persons: Anshul Gupta , Samarth Tandon , Vallari Dubey ,. Numerous investors and traders rely on such technical analysis for their trades. From lightning quick streaming data to full featured order entry and portfolio management, Interactive Brokers includes everything professionals require in three different high performing apps. For long term investors, monthly and yearly expiration dates are preferable.

Compare Funds With FINRA’s Fund Analyzer

This effort is all about hopefully enhancing your knowledge base and shining a light on the small yet crucial details and complexities of the investment world. This strategy involves predicting a stock’s movement to enter or exit positions. Investors’ discretion is required. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. The resources offered by these platforms can vary quite a bit, as some of them offer substantial educational resources you can use to learn the ropes. A buyer of this option would not need to put up the $6,300 in margin maintenance, but would only have to pay the option price. So, before investing, you need to choose a broker account. Additionally, tick size can affect your perception of risk. Com operates through the following subsidiaries. Day traders can earn big profits or pile up significant losses. There’s a rise in the index when the price of the stock rises and vice versa. There are several different types of trading in stock markets. Trial Balance as on 31st March 2019. Besides, it shows the trend’s movement duration and momentum. RHEC is registered under the applicable Polish law as a virtual assets service provider VASP in the Register of Virtual Currency Activities maintained by the Director of the Tax Administration Chamber. Account Opening Charge. KuCoin itself is one of the biggest players in the crypto trading world. They tend to have middle management style roles in investment banks, government agencies, and private investment firms, though they have a lot of room for advancement, given the importance of their job. Their combination of low fees, top notch security, and excellent customer support make them a standout choice in the crowded cryptocurrency trading space. I Sec is a Member of National Stock Exchange of India Ltd Member Code :07730, BSE Ltd Member Code :103 and Member of Multi Commodity Exchange of India Ltd. These can be books on basic share market vocabulary, the types of stocks you can get, or analytical research on market trends. Let’s look into the components of candlesticks next to understand how they form and what they represent.

Bearish Abandoned Baby Pattern

Proper due diligence has been done for the images and the image is not of any artist. This helps limit potential losses on any given trade. This process should be as seamless as possible so you can quickly get to start trading stocks. The trading strategy keeps track of the risks, returns, and impact of current trades on the investor’s portfolio. In India, the regulators authorized the European style of settlement. This means it may take longer for you to find someone looking to buy what you’re selling and, if liquidity is low, you may have to accept concessions on price to buy or sell a low volume crypto quickly. Saxo’s SaxoTraderGO mobile app boasts an impressive, intelligent design, coupled with an abundance of useful information that makes it easy for traders to make clear headed decisions when assessing markets and managing trading positions. Unexpected events like a payment default or an imbalance in trading relationships with another currency can result in significant volatility.

Chapter 3

When you open an account with a regulated brokerage, you can deposit money and make investments in the stock market. In the 2008 financial crisis, while most hedge funds closed shop, James Simmon’s firm reported its best year so far with an 80% return. Choose another country or region to see content specific to your location. Had I held until close today both positions would be up. Statutory Charges/Taxes would be levied as applicable. One standout feature is its virtual trading platform, which allows you https://pocketoption-ru.online/ to practice your trading skills in a risk free environment. You can check all the available auto sync options here: f you can’t find your broker, you can still use the Google drive sync method to sync yourtrades with your journal. I am someone that’s intressted about trading but i don’t know anything about it and i wanna start I just want to ask y’all on how to start. You’ll need to get some training if you want to grow your business by offering that sort of advice. This can obscure their decision making, expand their appetite for risk, and foster a false sense of command, resulting in imprudent choices. M pattern trading and W pattern trading present a lexicon of technical analysis that, when mastered, can signal key support and resistance levels and potential trend reversals. The reward schemes serve to stimulate traders to allow others to monitor and copy their trades instead of trading privately. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Examples include everything from central bank policy and geopolitical events to company earnings reports and balance sheets – basically anything you can think of which gives you information on an asset’s value and future direction. Here are a few important distinctions between the two. CFDs are complex instruments. » Learn how to invest in index funds. Similarly, political uncertainty or a poor economic growth outlook can depreciate a currency. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. The first component of risk management is deciding what portion of your overall capital will go into a particular trade. And it nabbed the top spot in the ease of use category of our ranking of Best Online Brokerages for Beginners, in no small part because of its investment app. Already have a Self Study or Full Immersion membership. The answer will mainly depend on how long you want to hold an asset before capturing profits. Note that when buying call options as CFDs with us, your risk is always limited to the margin you paid to open the position. The indicator is composed of two lines: the MACD line and a signal line, which moves slower. Get insights for the week ahead in the Indian market.

NSE Group Companies

Market order: Buys or sells the stock ASAP at the best available price. Its deposit and withdrawal options don’t attract a fee, and the app comes packed with features such as custom orders, real time charts, and economic indicators. If your prediction is correct, you’ll make a profit. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Payment method restrictions may affect traders in the US, Canada, Hong Kong and Germany but they can still deposit using cryptocurrency. Also, technical analysis and risk management are integral parts of trading and are covered by the books mentioned above. Featured Partner Offer. You can also use YouHodler to buy cryptocurrencies directly from your account using fiat currencies EUR, USD, GBP etc. You can either buy shares directly outright, in which case the return comes in the form of dividends and capital growth. Each bar contains the trade’s opening, highest, lowest, and closing prices. Tax Loss Harvesting+ TLH+ is not suitable for all investors. Generally, the practice of front running can be considered illegal depending on the circumstances and is heavily regulated by the Financial Industry Regulatory Authority FINRA. If you want more info on how to setup your MT4 trading platform checkout this metatrader 4 tutorial. A major challenge of AI in trading is its inability to predict black swan events and extreme market conditions, which are difficult to forecast. It will help if you keep some rules in mind when trading with double bottom and one of the rules is the market phase movement. Simplistic user interface. 51% to 89% of retail CFD accounts lose money. The analysis indicates that this stock, listed in the Nasdaq 100, shows a pattern of price rise by at least 0. Moving Averages: A statistical calculation to smooth short term fluctuations and highlight longer term trends or cycles. An MFI value above 80 typically indicates that the asset is overbought, suggesting a potential price decline in the near future. Innovative Technology at Its Best. Read my full review of IG to learn more about why I’ve rated IG so highly for so many years. A swing trading position is typically held longer than a day trading position, but shorter than buy and hold investment strategies that can be held for months or years. Spot bitcoin ETFs allow for the institutional trading of bitcoin at its spot, or current, price. Finally, because options trades are inherently shorter term in nature, you’re likely to trigger short term capital gains. If you have a little used vehicle, then why not rent it out. The best forex hedging strategies. It gets you rate and fee discounts for most of the bank’s products plus bonus credit card rewards. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. 7K ratings, with similar positive and negative comments.

PMS

03% per executed order. The Invested capital plus the debt comprises the capital structure. You can add trades to your journal in 3 possible ways. Options trading Journal. The accuracy of RSI signals can vary, but it’s known for its reliability when confirming trend formations or breakdowns. 3 Goods worth Rs 2,000 and Rs 1,500 withdrawn by Mahesh and Umesh respectively for their personal use. However, profits and losses are calculated on that full position size, and can therefore substantially outweigh your margin amount. Why Webull made the list: Webull is designed to be the best free app based platform for active and experienced stock traders, and it does a good job of it.